Intent-Centric Blockchain Systems: A Declarative Paradigm

The idea of intent-centric blockchain design represents a pivotal shift in how we interact with decentralized applications.

Instead of instructing a protocol on how to carry out specific actions, intent-centric systems let us state our end goals and leave the execution details to specialized solvers. This changes the dynamic of transaction-centric blockchains, where users must understand every step of the process — often a daunting and risky proposition. By focusing on outcomes rather than execution paths, intent-centric design promises to simplify user interactions, reduce errors, and lower the technical barriers that have long prevented broader adoption of decentralized applications.

An “intent” is simply a high-level request for a desired outcome. Rather than micromanaging each step of a token swap or smart contract call, users merely specify what they want to happen. Solvers then step in to determine how best to achieve that outcome, coordinating with validators and block proposers to finalize these intents on-chain. Because the user signs off on the final state change (for instance, sending 10 tokens to a particular address), they don’t have to worry about the granular mechanics of how the transaction is executed. This shift to a declarative model of interaction aligns with making blockchain more accessible: people can focus on their goals without needing to decipher the intricacies of the route taken.

The typical workflow in an intent-centric system begins when a user submits their goal, which is then shared across the network and stored in an intent mempool. Solvers — entities or algorithms that parse and fulfill these intents — examine the mempool and propose execution paths. A block proposer selects from these solved intents to create a block, which validators examine for correctness. Once consensus is reached, the new state is recorded on the blockchain. Network-wide visibility, competition among solvers, and on-chain validation aim to reduce malicious activity, though it is crucial to maintain transparent and effective oversight of solver behavior.

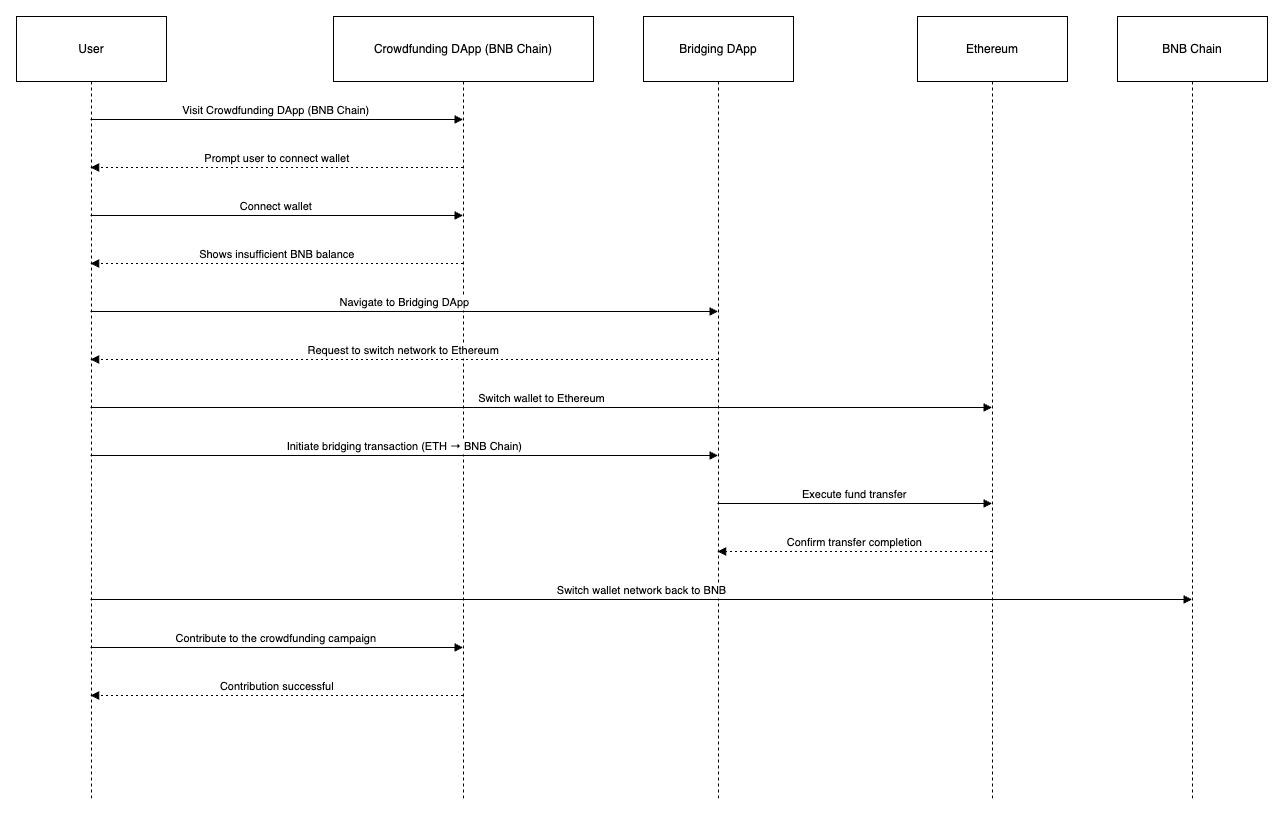

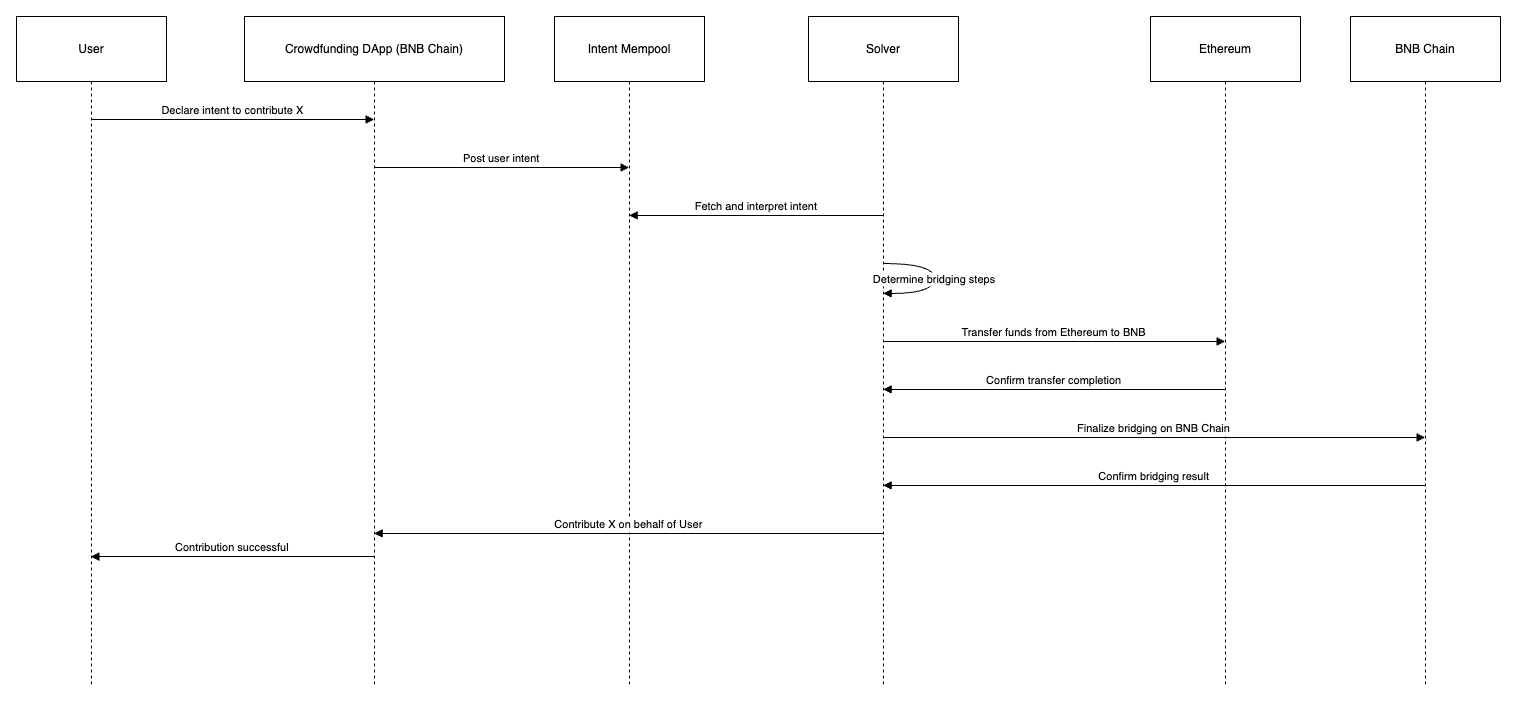

Below are the examples showing the transaction-centric approach(i.e. without intents) and the intent-centric approach for contributing to a crowdfunding campaign on the BNB Chain when most of the user’s funds are on Ethereum.

Transaction-Centric Approach

Steps:

The User (U) initiates the interaction by visiting the Crowdfunding DApp (D) on the BNB Chain.

They connect their wallet but discover they lack sufficient BNB to contribute.

The user then heads to the Bridging DApp (BD) to move funds from Ethereum (E) to the BNB Chain (BC).

After confirming the transfer, the user switches their wallet network back to BNB to finalize the contribution.

Each step requires manual actions by the user — switching networks, waiting for confirmations, and reconfiguring the wallet — illustrating the friction in a manual bridging process.

Intent-Centric Approach

Steps

The user simply declares their intent to contribute X tokens to the crowdfunding DApp.

The DApp posts this intent to the intent mempool where it’s picked up by a solver.

The solver determines the best bridging route and handles the entire process (transferring from Ethereum, confirming completion on BNB).

After bridging, the solver automatically contributes the user’s tokens to the campaign, and the user sees a success message — without juggling multiple steps or networks.

Comparing above sequence diagrams clearly shows a better user experience in intent-centric approach where user may just interact once for the successful scenario of whole crowdfunding process.

However, intent-centric design carries the potential for pitfalls often seen in other industries. In many markets, once certain providers achieve critical mass, they can engage in rent-seeking behavior: artificially raising costs, restricting competition, or prioritizing their own profit over user welfare. This same risk exists for intent-centric systems. If a handful of large solver entities gain control, they could gradually hike fees or favor transactions that benefit them at the expense of regular users. Over-reliance on solver networks might evolve into monopolies or oligopolies, undermining the decentralized ethos that gave rise to blockchain in the first place.

If the trust we place in solvers becomes entrenched, third-party companies could replace traditional power structures instead of decentralizing them. Even if multiple solver providers initially compete, the market could still coalesce around a dominant few. To combat this, the blockchain community can encourage an open, diverse marketplace of solvers, employ transparent fee models, and implement reputation systems to reward honest actors. Decentralized governance frameworks can further empower network participants to detect and deter self-serving practices. By taking these steps, we can preserve the benefits of intent-centric design — lowering barriers, simplifying complex use cases, and boosting accessibility — without allowing convenience to pave the way for monopolistic behavior.